Retail investors will never get access to life-changing venture capital opportunities in equity ventures. Venture capital offers unmatched wealth-creation opportunities. Increasingly, however, by the time the next great company files an IPO, the greatest gains would have already been had.

The 100x to 1,000x gains are in the early stage VC rounds, not the IPO.

Early equity rounds of good companies are not accessible to retail investors.

What retail investors are given access is the pool of early equity rejected by VC funds, major angel investors, and institutional investors. Retail investors like you and I are left with the VC rejects.

The trash.

How ICOs were Different?

The earliest tokens sales, dating pre-2017, have made their retail investors rich with returns at the scale of 100x to 1,000x, and beyond.

Recommended Articles

But the question beckons – Why these great opportunities were not gobbled up by VCs, notable angels, and institutions?

These platinum-clad investors largely avoid tokens. Hence, while retail investors only get to participate in only trash-grade early equity, they get to participate in BOTH good and trash token sales.

However, due to the success of early token sales, 2017-18 witnessed a massive surge in absolute trash-grade token sales. Picking good opportunities was equivalent to spotting a needle in a haystack. Scammers, projects with no product market/fit, or straight-up incompetent teams managed to raise capital. In the end, most investors were left with nothing, as it the case with equity crowdfunding.

The Dust has Settled

In the current aftermath of the ICO mania of 2017-18, funding for token sales has mostly dried up, yet interest in equity crowdfunding inexplicably continues to surge.

Moreover, the media has all but ensured people recognize cryptocurrencies as snake oil. As a consequence, equity crowdfunding continues to find new victims while even high-quality token offerings go without interest. The problem is not that people are uninterested in early stage investments, they are. The problem is that the current framework with which token sales are conducted is broken.

ICOs do not work because,

- No liability on the team

- No safety measures for investors

This is equally applicable to IEOs, which too place no liability on the team and offer no safety measures for investors.

Regardless, the appetite for early stage token investments should not be overlooked and should instead be encouraged due to the opportunities it offers to retail investors. The market’s disgruntlement with the current token sale framework is justifiable, understandable, and rational. Hence, the need for a new token sale framework: Dynamical Coin Offerings.

What is a Dynamic Coin Offering (DYCO)

A token sale that succeeds, or else the token buyers get their money back.

A DYCO is the first early stage token investment opportunity that creates a price floor in the secondary market, thereby offering down-side protection to investors without limiting their upside. It also holds the token issuer liable, without turning the token into a security.

Furthermore, while it is currently designed for token sales, its implications can be easily extended to even equity crowdfunding.

How Does a DYCO Work?

A Dynamic Coin Offering issues money-backed utility tokens are issued. 80% of the funds raised in a DYCO are set aside to buy-back all holders’ tokens, if they are unhappy with their token purchase.

This gives all DYCO tokens a price floor.

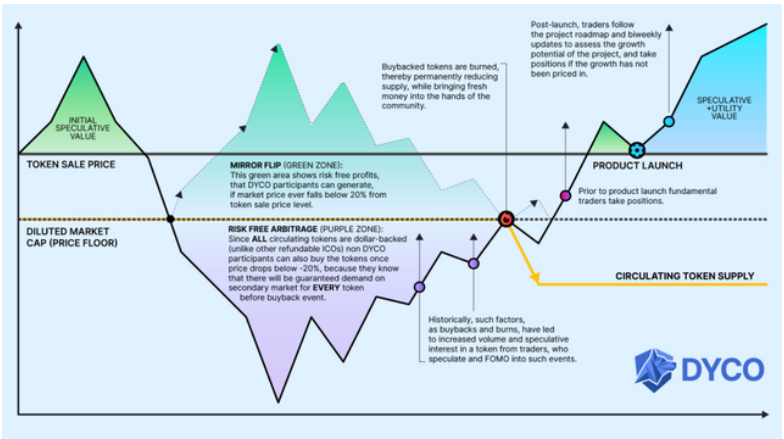

The price floor is at 0.8x of the sale price. This token’s speculative value and utility value are added atop this price floor. The token buy-backs are conducted at 9, 12, and 16 months after the token generation event.

- On the 9th month, 25% of the tokens are refunded

- On the 12th month, 37.5% of the tokens are refunded

- On the 16th month, 37.5 of the tokens are refunded

This timeline is of critical importance as it gives the team crucial time to prove the viability of the development. Each buy-back date thus acts as a milestone at which performance must be assessed.

- If the team has not done well, holders claim a buy-back.

- If the token performs poorly at all 3 milestones, holders claim a buy-back.

- If a team is not being transparent, holders claim a buy-back.

Buy-backs can be claimed for all sold tokens, thereby eliminating a project. On the other hand, if a team performs well, as would be reflected in token appreciation by the time each milestone arrives, holders will not need to claim a refund, and thereby unlocking a portion of the funds set aside for buy-backs to instead be used for scaling the development.

Important Characteristics of a DYCO

A. Token Burns

In a DYCO, only purchased tokens are circulating till the last buy-back date. This means a project goes through 16 months of no inflation.

Instead, each time a buy-back is conducted, the refunded tokens are burned.

This mechanism ensures that any tokens by people who lack faith in the development can exit their position, till eventually the only holders are the true believers of the project.

This means that DYCOs are expected to have a deflationary net supply. It also means that teams that are not transparent, drift away from their roadmap, or simply turn out to be incompetent end up having to buy-back the entire circulating supply, thereby eliminating the token (and the project).

B. Mirror Flip

As every token can be claimed for buy-back at 80% of the money paid for it during the DYCO, each token is supported with a price wall on the secondary market.

This means if the token price on exchanges ever falls below 0.8x, the tokens can be bought for a buy-back claim for risk-free profit. This is a mirror-flip: DYCO participants can make money if the token up or down.

For example:

Suppose 10 tokens are sold for $1 each. If these tokens start trading on an exchange at $0.5 each, they can be bought and a refund can be claimed for $0.8 per token, allowing an arbitrage opportunity to make $0.3 per token risk-free.

Mirror Flip & Secondary Market Visualized

C. An Incredible Secondary Market

Given that every token has a price floor, secondary market participants have incentives to participate in this token’s liquidity. The secondary market will include:

- Arbitrage Traders

- FOMO Traders

- DYCO Participants

- Fundamentals-Driven Traders

Arbitrage traders will join in to offer liquidity to tokens that fall deeply below the price floor as they know DYCO participants will eventually want these for risk-free profits.

The DYCO has in-built dates on which tokens can be expected to be bought-back and burned. This reduces supply while putting fresh capital back in the hands of the secondary market. Such events have historically brought in a surge of FOMO-driven traders. DYCO participants themselves will be ready to claim risk-free profits on mirror flips.

Ushering a New Era of Token Sales

Success or your money back is the token sale framework under Dynamic Coin Offerings.

Retail investors can access the wealth-generating opportunities early stage investments can offer while having down-side protection, without hindering the upside potential. Simultaneously, they are given the right to decide whether or not a development can continue, thereby granting powerful rights to hold teams liable without turning the token into a security.

The first project to utilize a Dynamic Coin Offering will be announced in May

- FBI Issues Warning Against Non-Compliant Crypto Money Services

- Fed Rate Cut Hopes Dampen Amid Surging Q1 Inflation

- ViaBTC Auctions “Epic Sats” From Latest Halving Auctioned Off For $2.13M

- Aimie Killeen Appointed as Chief Legal Officer of Digital Currency Group

- Bitcoin Whales Taking Unrealized Profits Could Impact The Market: Report

- Can Terra Classic Coin Leverage Market Consolidation For a Price Rally?

- 2 Trending Altcoins To Hold Targeting 100X Profit Post Bitcoin Halving

- Top 3 Crypto To Invest In 2024 – Expert Reveals

- Bitcoin Price Today: Are Curtains Closing On Explosive $100,000 BTC Rally In 2024?

- Dogecoin Price Forecast: Is the Current Dip a Buying Opportunity?

Mallconomy

Mallconomy  WienerAI

WienerAI